louisiana inheritance tax waiver form

The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. It offers numerous professionally drafted and lawyer-approved forms and samples.

Louisiana Liability Waiver And Release Form Pdfsimpli

This doesnt mean youre stuck though.

. Contact us today at 678 462-8861 to learn more about how we can serve you. The NFTL does not actually create the lien. You are being directed to a third party site to submit this form electronically.

For example if you bought a car or a house and cannot continue paying the monthly instalments you cannot file a claim of exemption on that particular house or car. There are limits on what an executor can and cannot do. 57 rounded up 14.

An executors authority isnt endless. In cases where you owe state inheritance taxes those are specifically excluded and cannot be claimed as a deduction. Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022.

Gift Tax Limit. During this time you cant do anything with the property other than maintaining it. By clicking continue you consent to being directed to this third party site.

In general a last will and testament is an easy and and straightforward way to state who gets what when you die and name a guardian for your minor children. Subtitle A Chapter 1 Subchapter S have. For current information please consult your legal counsel or.

Other taxes such as federal income tax gift tax or inheritance tax may also be incurred by a quitclaim deed transfer. However most states provide various exemptions from the transfer tax such as transfers between parents and children. This is the time to prep all of the needed documents.

Therefore that amount does affect eligibility for cost assistance and Medicaid. Stay with us and well give you a solution to how you can start the sale process. The waiver had to be signed by the survivor while the couple was still married.

Royalties The holder of a right to royalties receives a portion of the revenues from the production of a mineral fee estate in the form of a. So lets say that in 2021 you gift 216000 to your friend. Its not an inheritance because the money has always belonged to the husband.

If the judgment debtor fails to complete this form. These separate mining rights can be gifted and bestowed as an inheritance and passed down through generations. In states that require this form there may be certain ways to get out of completing it such as satisfying the judgment by paying what is owed or filing a timely appeal.

The institution that administers the qualified plan usually provides a waiver form when the employee signs up for the retirement plan. The institution that administers the plan normally provides a waiver form. Request for Louisiana Tax Assessment and Lien Payoff 09012010 - present.

A Notice of Federal Tax Lien is a document that is publicly filed with state and local jurisdictions. Nonetheless Indianas inheritance tax was repealed retroactively to January 1 2013 in May 2013. For full access to 85000 legal and tax forms customers just have to sign up and choose a subscription.

Youll need to provide a death certificate will and a petition form. Inheritance Legal Issues Involved with Real Estate. Download Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property from the US Legal Forms web site.

The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012. Waiver or Release of Right. The IT-201 is a New York State income tax return form.

Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005 in the Securities Transfer Guide a publication of CCH Incorporated or obtained from the applicable state tax agency. This form is then provided to the individual who won the judgment. Notice of Federal Tax Lien or NFTL.

Generally the document is used if a person dies without a will and the probate court is trying to determine how the estate should be distributed. Savings arent counted when determining Medicaid or Cost Assistance. Heres what you should know.

If a taxpayer is required to register and file a return with the State of Louisiana for purposes of collecting sales tax is the taxpayer also required to file for purposes of incomefranchise tax. This applies to earned income such as wages and tips as well as unearned income such as interest dividends capital gains pensions rents and royalties. A last will and testament is the foundation of an estate plan which lets you plan for your estate after youre goneHowever there are certain things that you might not want to put in your will.

This is true whether you reside inside or outside the United States and whether or not you receive a Form W-2 Wage and Tax Statement or Form 1099 from the foreign payer. If the debt originated from the purchase improvement or loan on that property then it cannot be exempt. These codes may not be the most recent versionLouisiana may have more current or accurate information.

An Affidavit of Heirship is a written solemn oath that verifies the named individual is a legal heir of someone who died. For a partnership to have this election in effect it must make the payments required by section 7519 and file Form 8752 Required Payment or Refund Under Section 7519. The partnership elects under section 444 to have a tax year other than a required tax year by filing Form 8716 Election To Have a Tax Year Other Than a Required Tax Year.

Exemptions may not be available for certain tax liens. Inheritance tax is typically paid by the estate. At Viable Tax Solutions LLC we offer a range of services including.

Accounting bookkeeping tax preparation and planning tax resolution and business services. In fiscal year 2021 the federal deficit totaled nearly. The transfer tax is usually a small percentage of the consideration or purchase price.

We make no warranties or guarantees about the accuracy completeness or adequacy of the information contained on this site or the information linked to on the state site. The laws regulating the inheritance of tax-advantaged retirement assets are obviously complicated and. The federal tax lien is sometimes referred to as the statutory lien or silent lien The term lien is often confused with the notice of the liens existence that is filed by the IRS ie.

A spouse can waive the right of inheritance to the estate of the other spouse by an antenuptial agreement which is fairly entered into by both parties with knowledge of all the relevant facts such as the extent of the spouses wealth. Council tax on my buy-to-let has quadrupled to 7000 Landlords face soaring bills as their properties are suddenly reclassified for council tax purposes By. Most taxpayers wont ever pay gift tax because the IRS allows you to gift up to 1206 million over your lifetime without having to pay gift tax.

Does a corporation that made the federal election to be taxed in accordance with the provisions of 26 USC. These plans give the surviving spouse the right to inherit all money in the account unless the survivor signed a waiver giving up his or her rights and allowing the other spouse to name a different beneficiary. This is the lifetime gift tax exemption and its up from 117 million in 2021.

Sports Waiver Form Fill Online Printable Fillable Blank Pdffiller

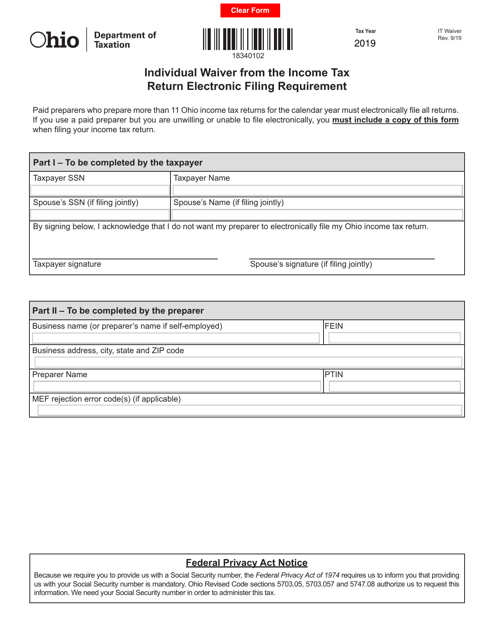

Form It Waiver Download Fillable Pdf Or Fill Online Individual Waiver From The Income Tax Return Electronic Filing Requirement Ohio Templateroller

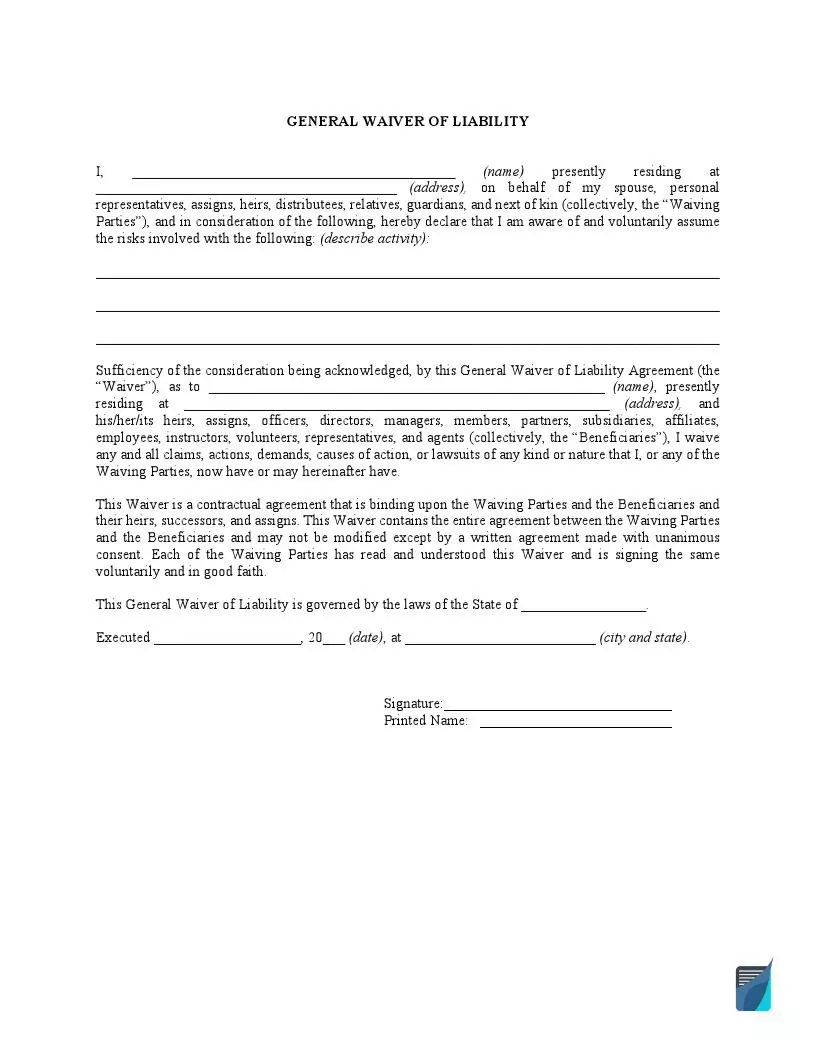

Waiver Of Liability Waiver Fill Online Printable Fillable Blank Pdffiller

Sample Printable Deed To Strip Of Land On Which Wall Encroached Form Real Estate Forms Word Template Real Estate Contract

Need A Inheritance Tax Waiver Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com Inheritance Tax Tax Forms Templates

91 Direct Debit Form Template Page 4 Free To Edit Download Print Cocodoc

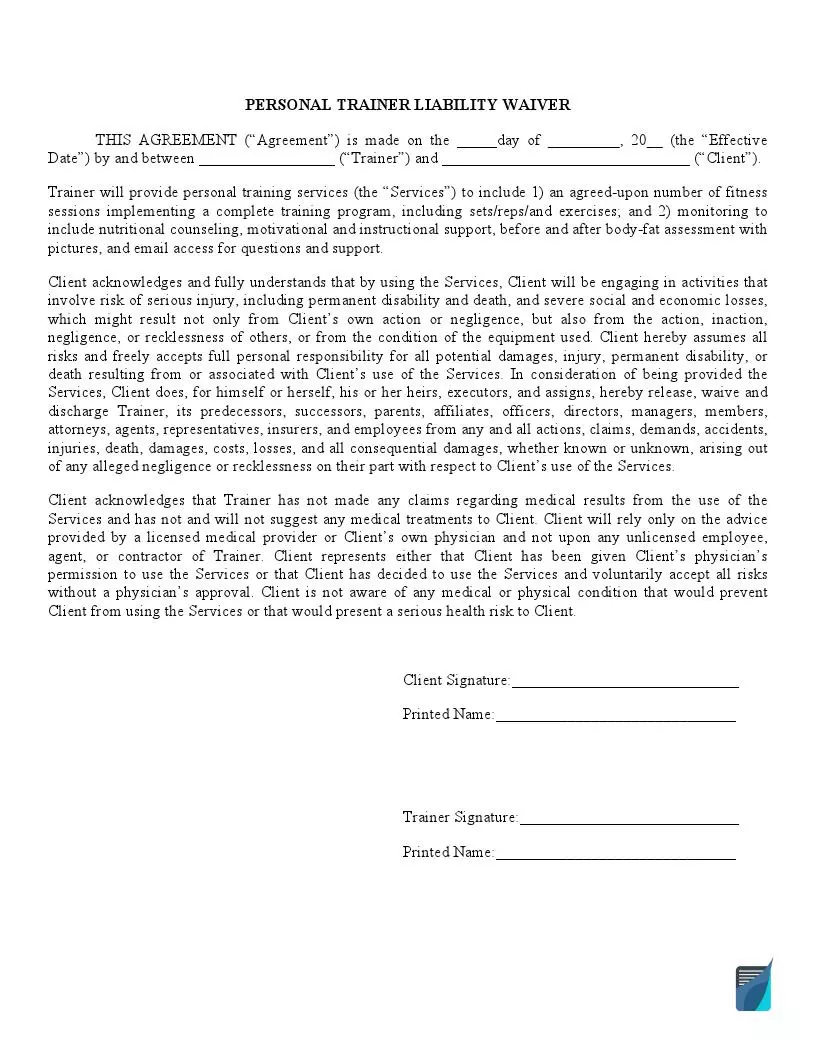

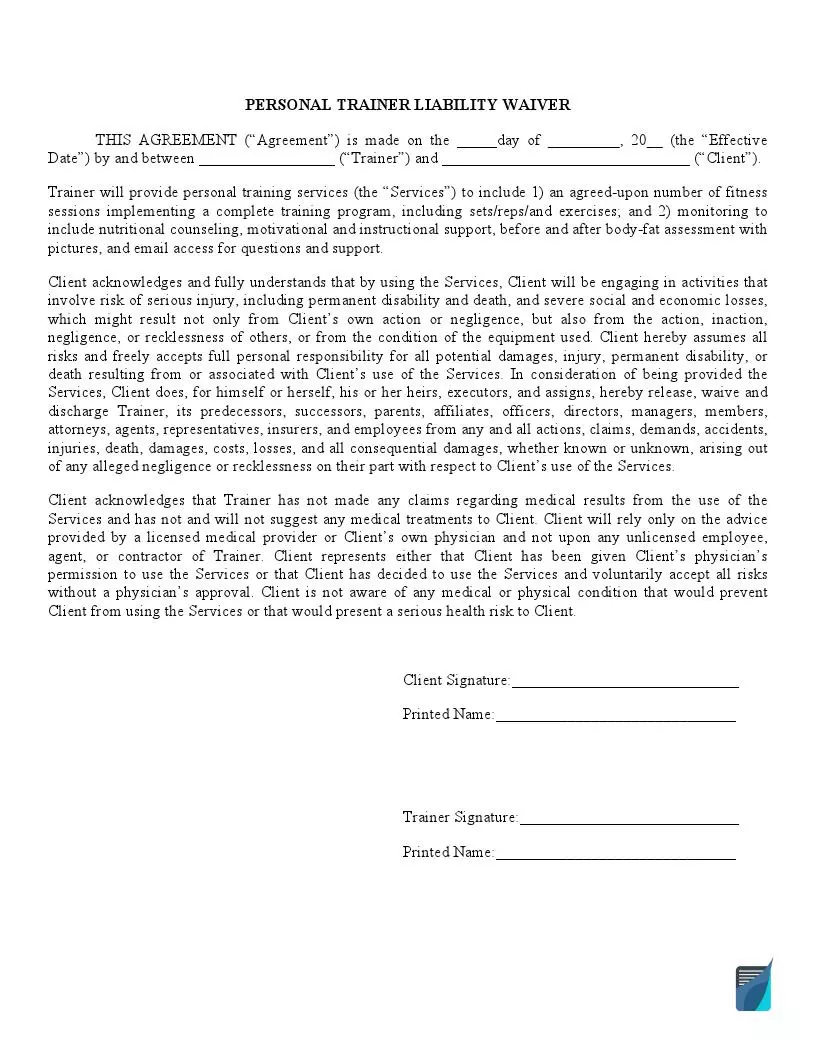

Free Personal Training Liability Waiver And Release Form

Free Liability Waiver Form Sample Waiver Template Pdf

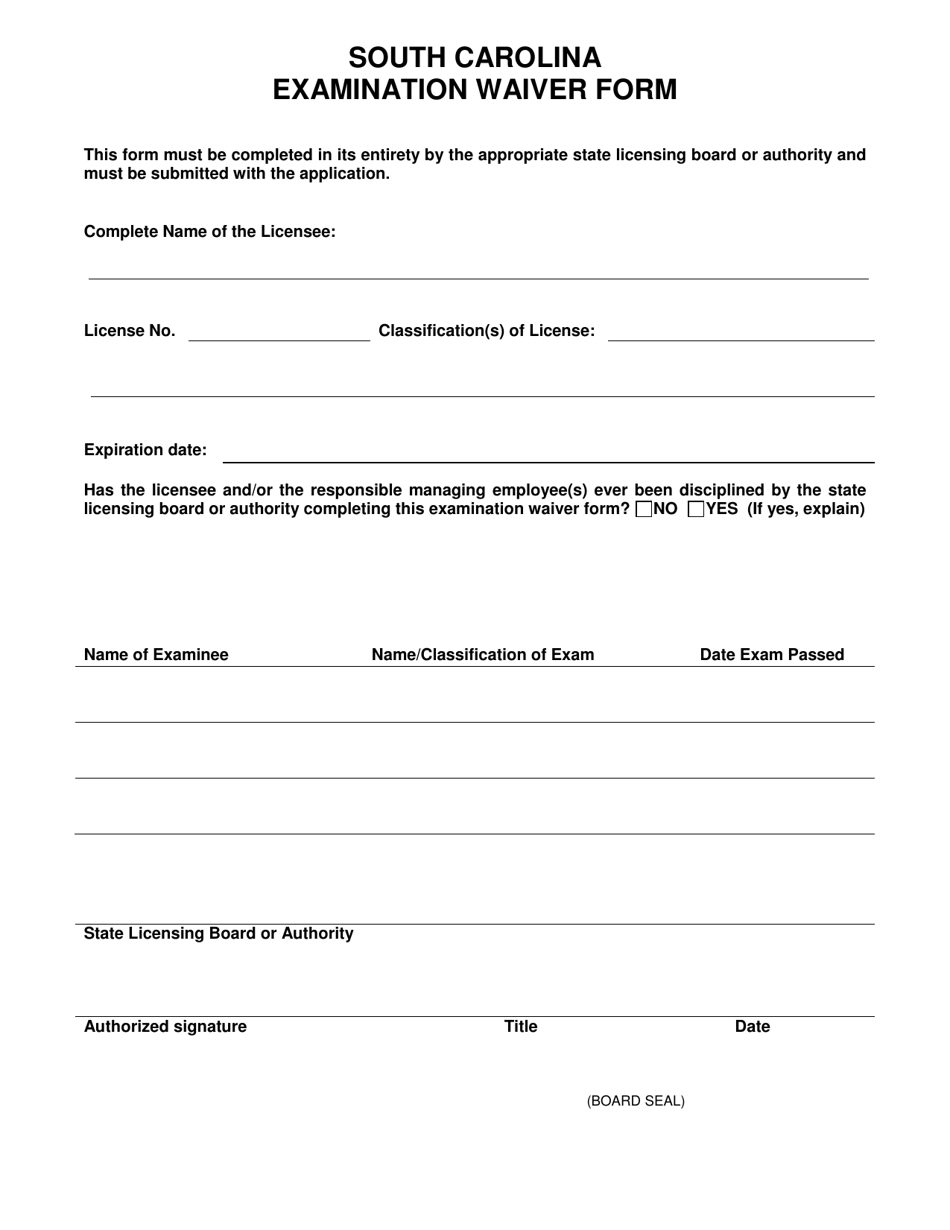

South Carolina South Carolina Examination Waiver Form Download Printable Pdf Templateroller